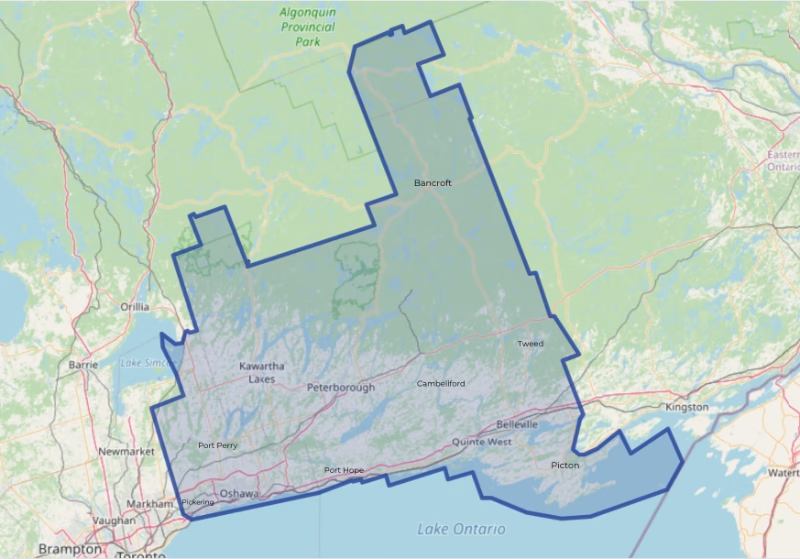

The Central Lakes Association of REALTORS® has released its January 2026 Housing Market Statistics, reflecting seasonally typical market activity at the start of the year. Sales levels remained consistent with late-year trends, while average sale prices showed modest month-over-month increases across several Regions, pointing to areas of emerging price stability. New listing activity remained active, supporting steady inventory levels and providing buyers with continued choice.

“With sales and prices adjusting across much of the Region in January, the data points to a market that is creating opportunities for those who are well prepared,” said CLAR President Christine Riley. “As inventory levels remain healthy, REALTORS® are well positioned to help clients assess value, pricing strategies, and timing as the market moves into the new year.”

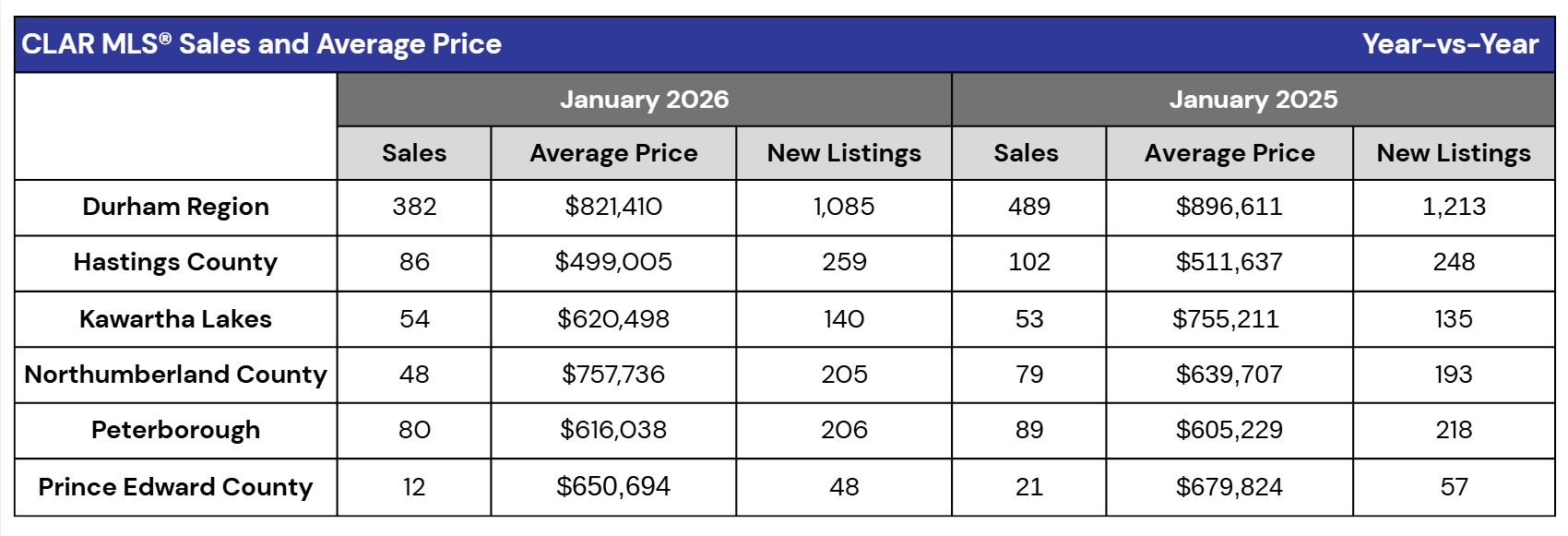

Durham Region recorded 382 home sales in January, down from 455 in December, reflecting the typical seasonal slowdown at the start of the year. The average selling price eased 2.7% month-over-month to $821,410, while remaining lower than January 2025’s average of $896,611. New listings totalled 1,085, down 10.6% year-over-year, while active listings increased to 1,480, providing buyers with more choice. Homes spent an average of 39 days on the market, up from 30 days last year, underscoring the importance of strategic pricing and professional guidance in today’s evolving market.

Hastings County recorded 86 home sales in January, down 5.5% month-over-month from 91 in December, reflecting the typical seasonal slowdown. The average selling price was $499,005, up from December’s $466,716 as winter market conditions took hold. New listings totalled 259, up from 123 last month, as active listings continued to provide adequate inventory levels. Homes spent an average of 69 days on the market, in line with longer selling timelines typical for this time of year.

Kawartha Lakes recorded 54 sales in January 2026, almost unchanged from 52 in December 2025 and 53 in January 2025, pointing to consistent buyer activity. The average sale price rose 2.7% month-over-month from $604,056 in December to $620,498 in January 2026, but remained 18% lower than January 2025’s average of $755,211. New listings increased to 140, up from 135 a year earlier and 75 a month earlier, adding to available inventory and providing buyers with more choice as the market enters the early months of 2026.

Northumberland County recorded 48 home sales in January 2026, down from 70 sales in December and 79 in January 2025. The average selling price increased 12.8% month-over-month, rising from $671,750 in December to $757,736 in January, while remaining higher than January 2025’s average of $639,707. New listings totalled 205 as homes spent an average of 40 days on the market, improving from 63 days last year, suggesting quicker sales despite softer overall transaction volume.

The Peterborough Region recorded 80 home sales in January 2026, down 8.05% month-over-month from 87 sales in December, and 10.11% lower year-over-year when compared to 89 in January 2025. The average sale price was $616,038, representing a slight 0.18% decrease from December’s $617,177, while remaining 1.8% higher than January 2025’s average of $605,229. New listings totalled 206, up significantly from 78 in December, but slightly below 218 listings the year earlier, with homes spending an average of 61 days on the market, compared to 48 in January 2025.

Prince Edward County recorded 12 home sales in January 2026, down month-over-month from 22 sales in December, and lower year-over-year compared to 21 sales in January 2025. The average sale price was $650,694, representing a 5.75% month-over-month increase from $615,276 in December, while remaining 4.29% lower than January 2025’s average price of $679,824. New listings totalled 48, down from 57 a year earlier, as homes spent an average of 75 days on the market, compared to 95 days in January 2025, indicating improved selling timelines despite reduced transaction volume.

“With the Bank of Canada maintaining its overnight lending rate at 2.25%, borrowing conditions remain relatively stable as we move into early 2026,” said CLAR CEO Wendy Giroux. “Following a quieter fall and winter market, we are hopeful for an early spring market supported by the strong inventory levels currently available.”

SOURCE, CLAR CENTRAL LAKES ASSOCIATION OF REALTORS®

To learn more, visit CLAR CENTRAL LAKES ASSOCIATION OF REALTORS®

Disclaimer: CLAR will release its Regional housing statistics on the second business day of each month. Additional market statistics providing deeper analysis at the regional and city level will be released on or before the fourth business day of each month.