In December, 398 homes exchanged hands via the MLS® (Multiple Listing Service) System of the London and St. Thomas Association of REALTORS® (LSTAR). That was up 0.8%, compared to the same month a year ago, and marked the best December since 2021. Overall, 6,938 homes were sold in 2025, down 5.0% from 2024.

“Interestingly, the sales-to-new listings ratio showed quite a rebound in December,” said Dale Marsh, 2025 LSTAR Chair. “It was 71.6, noticeably higher than November, which was 49.5. According to the Canadian Real Estate Association (CREA), a sales-to-new listing ratio between 45% and 65% indicates conditions of a balanced market. December activity started to show signs of the conditions consistent with a sellers’ market. December’s 71.6 sales-to-new listings ratio was the highest recorded in 2025.”

Average sales price posted an increase from the previous month as well. It was $614,104 in December, down 3.4% compared to the same time in 2024. In November, average sales price was $604,994.

“Inventory continues to remain at a historical high level,” Marsh said. “There were 5.4 months of inventory in December, that’s more than the 4.6 months of inventory recorded in December 2024. With inventory and the fluctuating sales-to-new listings ratio, your local REALTOR® can help you navigate the marketplace, if you’re considering to buy or sell a home.”

The table below displays December’s average prices and MLS® HPI Benchmark Prices in LSTAR’s main regions.

| Area | December 2025 MLS® HPI Benchmark Price | December 2025 Average Price |

|---|---|---|

| Central Elgin | $648,500 | $656,395 |

| London East | $427,700 | $491,086 |

| London North | $610,100 | $666,049 |

| London South | $551,800 | $631,829 |

| Middlesex Centre | $763,000 | $1,028,086 |

| St. Thomas | $525,800 | $598,634 |

| Strathroy-Caradoc | $711,200 | $577,438 |

| LSTAR | $552,800 | $614,104 |

The HPI benchmark price reflects the value of a “typical home” as assigned by buyers in a certain area based on various housing attributes, while the average sales price is calculated by adding all the sale prices for homes sold and dividing that total by the number of homes sold. The HPI benchmark price is helpful to gauge trends over time since averages may fluctuate by changes in the mix of sales activity from one month to the next.

The following table displays December’s benchmark prices for all housing types within LSTAR’s jurisdiction and shows how they compare with those recorded in the previous month and three months ago.

| MLS® Home Price Index Benchmark Prices | |||

|---|---|---|---|

| Benchmark Type | December 2025 | Change Over November 2025 | Change Over September 2025 |

| LSTAR Composite | $552,800 | ↓1.3% | ↓2.5% |

| LSTAR Single-Family | $610,700 | ↓0.4% | ↓1.4% |

| LSTAR One Storey | $538,900 | ↓1.1% | ↓1.0% |

| LSTAR Two Storey | $669,800 | 0.0% | ↓1.7% |

| LSTAR Townhouse | $435,000 | ↓5.2% | ↓7.1% |

| LSTAR Apartment | $324,000 | ↓1.8% | ↓7.7% |

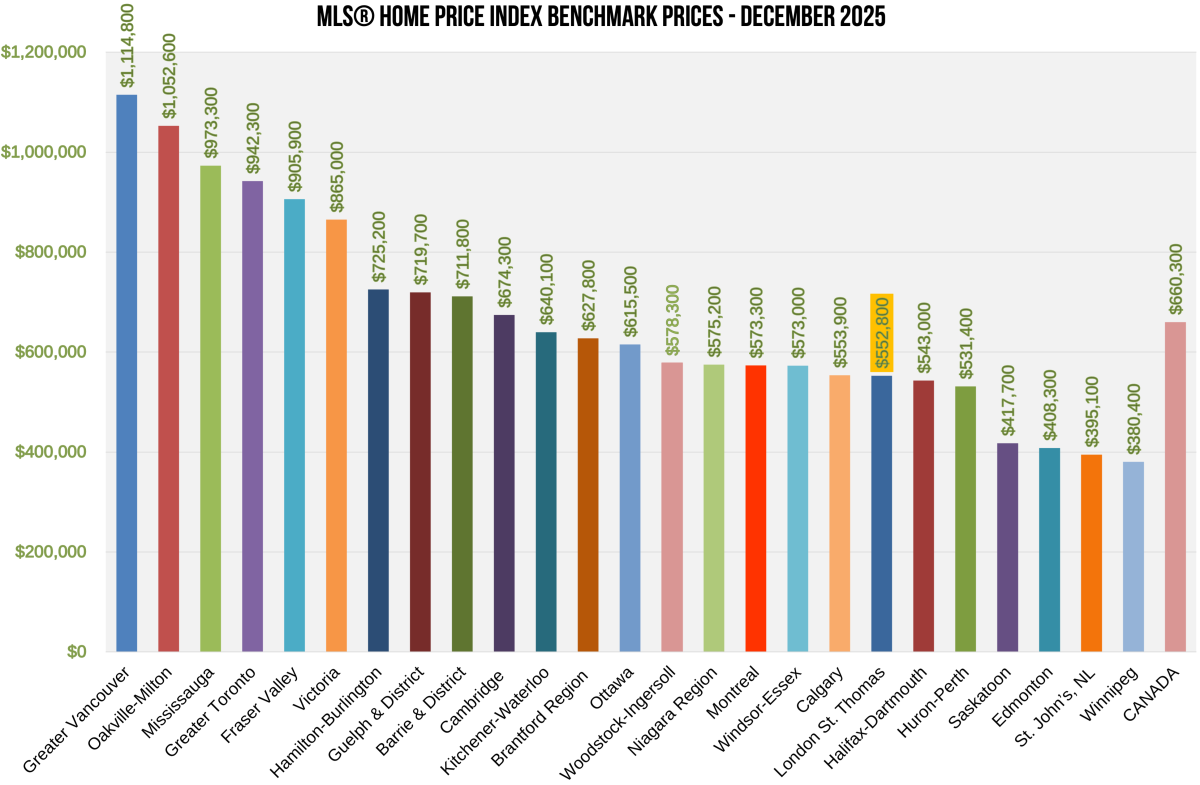

The chart below shows the most recent HPI benchmark prices across the country, courtesy of CREA.

According to the latest study1 by Altus Group, an average housing transaction in Ontario generated an average of $124,200 in spin-off spending per transaction from 2022 to 2024. These expenses include legal fees, appraisers, moving costs, new appliances, and home renovation expenses.

“Based on December sales, that means more than $49 million was potentially generated in spin-off spending,” Marsh said.

Employment resulting from home sales is also significant, according to the Altus study. Resale housing activity created an estimated 117,610 jobs annually in Ontario from 2022 to 2024. Jobs include manufacturing, construction, skilled trades, finance, and insurance.

1Economic Benefits Generated by Home Sales and Purchases Over MLS® Systems Across Canada, Altus Group, 2025.

SOURCE, LSTAR

To learn more, visit LSTAR