It’s the most comprehensive study in Canadian Real Estate, brought to you by RE/MAX Canada.

REMAX brokers and agents share an overview of national housing market activity in 2025 and their outlook for the year ahead.

The Canadian housing market could be on the upswing looking ahead to 2026, with more buyers preparing to enter the market and home sales expected to increase by 3.4 per cent next year. This follows signs of renewed buyer intent earlier this fall, compared to the first half of the year.

Consumer Sentiments:

- 10% of Canadians plan to buy a home in the next 12 months, and half of them are first-time homebuyers.

- More than one quarter of Canadians believe the housing market in their region will be more affordable in 2026.

- 23% of Canadians would be ready to buy if Bank of Canada interest rates fell further, by another 0.5 to one per cent.

“Amid looming economic clouds, Canadians are maintaining their interest in homeownership,” says Don Kottick, President, REMAX Canada. “The resilience that began to emerge in the fall is anticipated to continue into 2026, with first-time buyers in particular finding creative ways to save and enter the market.”

Remote Work and Homeownership

Following looming economic headwinds, an emerging concern among first-time homebuyers is a rise in return-to-office mandates.

17% of Canadians are concerned about ‘return to office’ mandates

Respondents aged 18 to 34 and those planning to buy in the future are thinking more about how this might affect their search

Nearly half of respondents overall do not believe return-to-office will impact their situation

First-Time Buyers Gain Confidence as Rates Decline

According to a Leger survey commissioned by REMAX Canada, 10 per cent of Canadians say they’re planning to purchase a home in the next 12 months – an improvement from seven per cent in the fall, based on Leger survey data earlier this year. Although more than half of Canadians are feeling the economy will worsen in 2026, following an initial economic stall as seen in the earlier part of 2025, Canadians aged 18 to 35 are more hopeful, with 21 per cent feeling the economy will fare better next year.

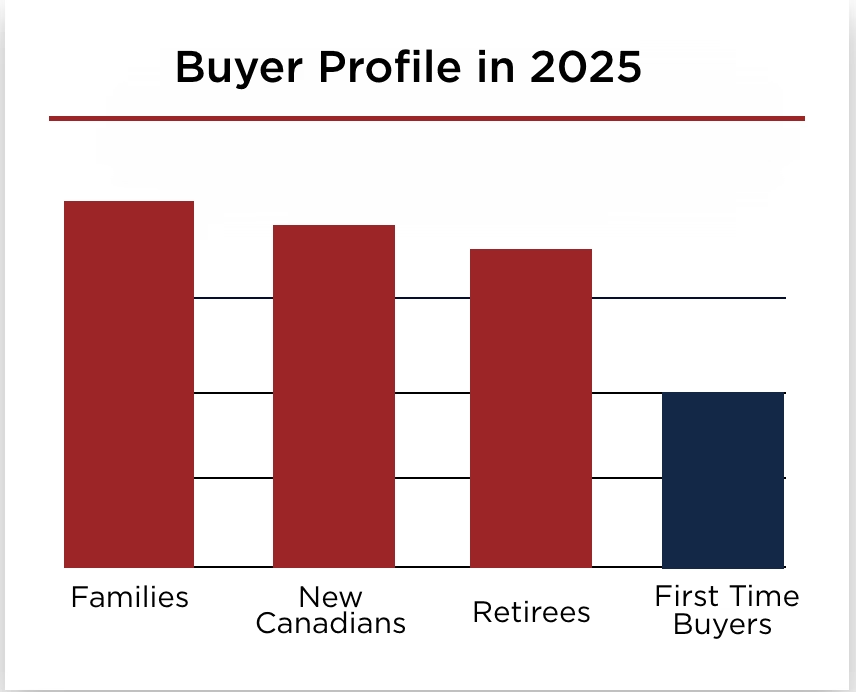

A Shifting Buyer Profile

REMAX brokers and agents across Canada found that families, new Canadians, and retirees drove a larger share of sales in 2025, marking a significant shift from 2024, when first-time buyers led sales across most Canadian markets.

Buyer Profile in 2025

Families

New Canadians

First Time Buyers

Retirees

While 17 per cent of Canadians say they plan to purchase a home at some point (with 10 per cent intending to buy within one year). Brokers are hearing that many buyers continue to watch the market closely for the right moment to make their move. Those planning to purchase their first home are more likely to be aged 18 to 34 and with kids under age 18.

Stay ahead of market trends with expert insights and advice delivered right to your inbox!

Regional Market Trends

REMAX brokers and agents across Canada shared a year-over-year analysis of their local market between January 1 and October 31, 2025 and offer their estimated outlook for 2026. According to their insights, as well as local board data, just over one third of markets are expected to transition from buyers-to-balanced conditions, while 15.8 per cent of markets are sellers’ and 10.5 per cent remaining buyers’ markets. The remaining markets are expected to be varied, heading into 2026.

Altantic Canada

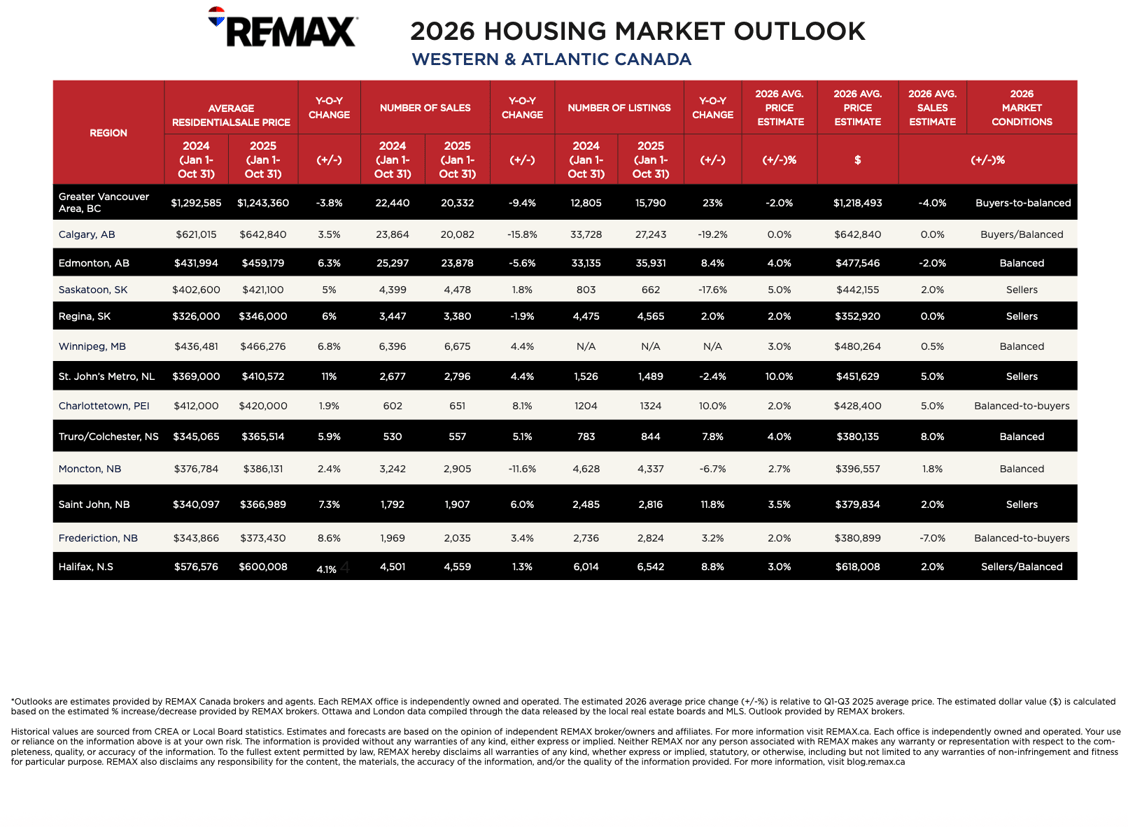

Atlantic Canada’s housing market is stabilizing as the region transitions toward balanced conditions, supported by steady in-migration, moderate price growth, and increasing new-home construction. Average residential sale prices are projected to rise three to five per cent across most markets, with single-detached and semi-detached homes continuing to drive demand. First-time buyers are returning with confidence, prioritizing affordability, low-maintenance homes, and family-friendly neighbourhoods, while move-up buyers are focused on lifestyle upgrades, larger spaces, and energy-efficient properties. Retirees are seeking downsized, accessible housing or low-maintenance condos in communities that offer healthcare access and amenities.

New developments, particularly in Moncton, Fredericton, and Truro, emphasize affordability and sustainability, helping support a balanced market. Number of sales transactions year-over-year from were notably highest in St. John’s Metro, Newfoundland, from 2,677 to 2,796, an increase of 4.4 per cent. Rising rents are encouraging renters to transition into homeownership, and investor activity remains strong in rental and multi-unit properties, reflecting ongoing confidence in the region’s long-term growth potential. Overall, Atlantic Canada presents a stable, predictable, and affordable market, making 2026 a strategic year for buyers and investors alike.

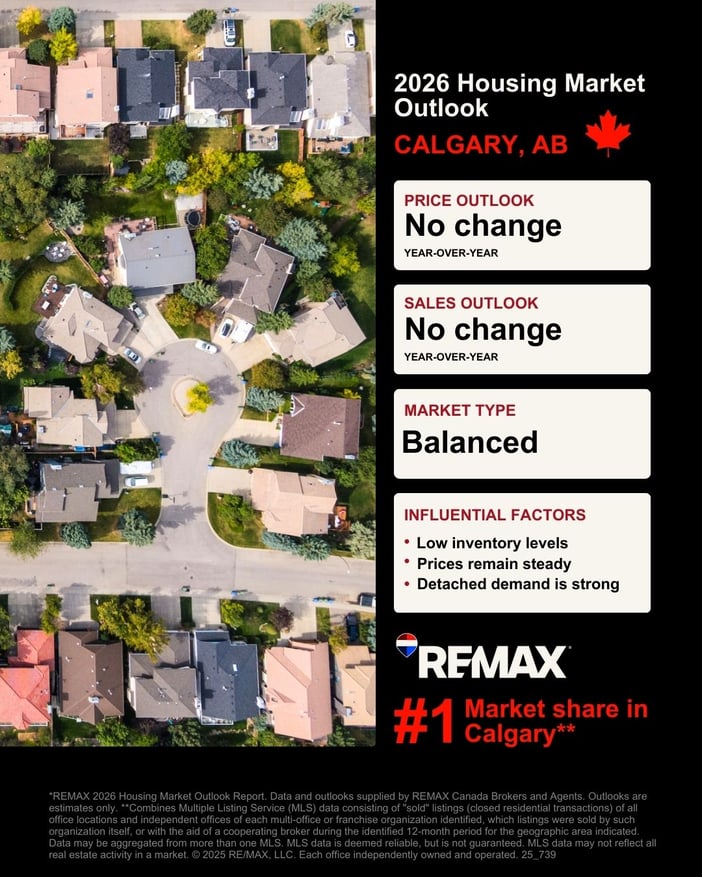

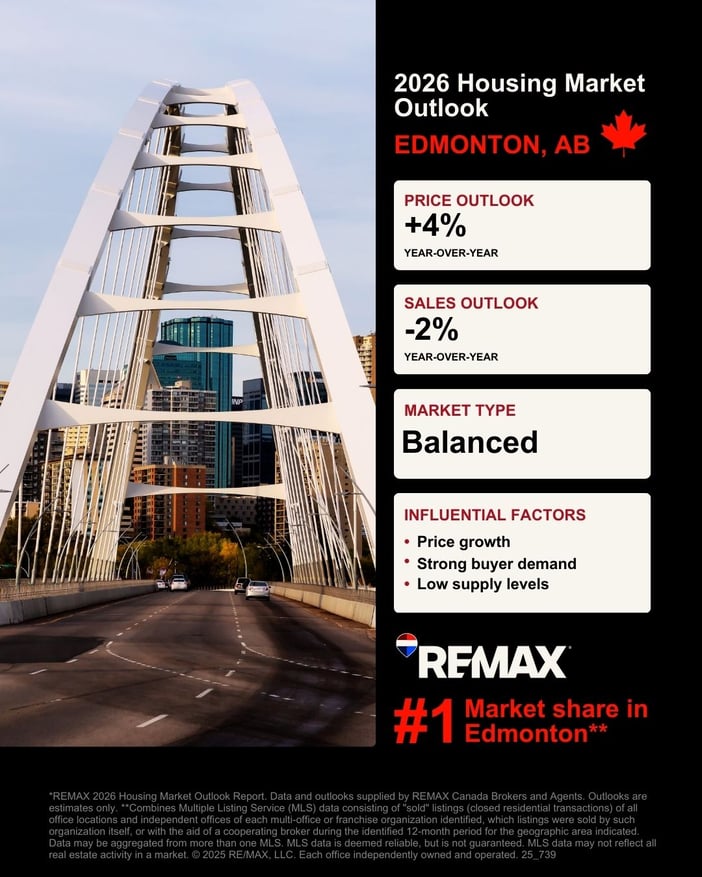

Western Canada

Western Canada’s housing market is entering 2026 with measured stability. In Vancouver, high-end property prices decreased notably by 6.3 per cent year-over-year from 2024 to 2025, from $2,651,000 to $2,483,000, favouring buyers due to increasing inventory, while entry-level homes remain in strong demand. Calgary and Edmonton present more balanced markets, with suburban single-detached homes driving activity as affordability and long-term growth potential attracts first-time and move-up buyers. Regina and Winnipeg continue to favour sellers, supported by lower inventory levels and steady demand for single-detached homes, particularly among first-time buyers and families seeking turnkey properties with ample space.

Across the region, single-detached homes dominate buyer interest, while retirees increasingly look to downsize to more low-maintenance properties. First-time buyers are seeking value and proximity to essentials, especially access to transit. Move-up buyers focus on lifestyle and larger homes, often leveraging subject-to-sale offers. New-home construction is proceeding modestly in high-cost markets like Vancouver, while mid-sized cities are seeing greater activity in infill and detached housing. Technology, social media, and virtual tours are playing an increasing role in how buyers search for and evaluate properties. Declining interest rates and favourable financing conditions into 2026 are anticipated to unearth an existing motivation to enter the market.

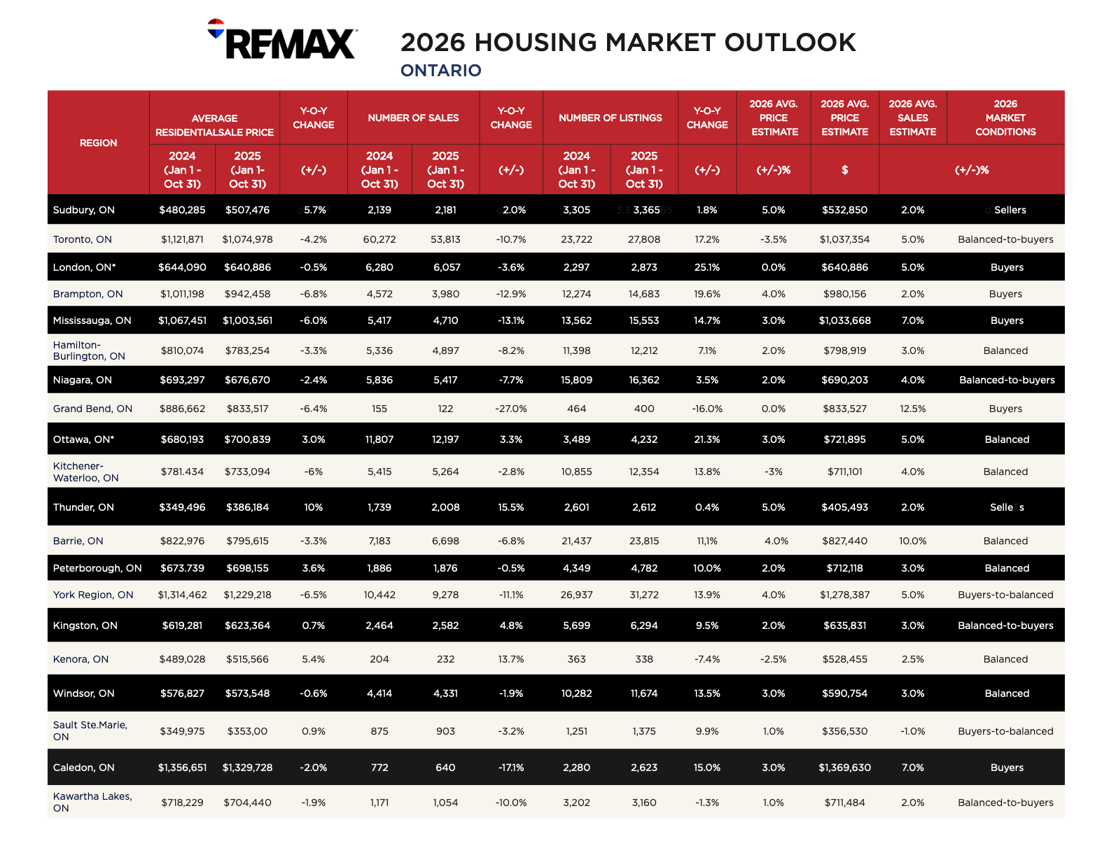

Ontario

Ontario’s housing markets are showing a blended mix of buyer-friendly and balanced conditions, shaped by regional differences such as population, pricing, and economic stability. Markets toward Northern Ontario such as Kenora, Sudbury, and Sault Ste. Marie remain relatively stable, with modest price growth, limited new construction, and steady demand from first-time and move-up buyers. Mid-sized cities, including London, Kitchener-Waterloo, and Simcoe County, are seeing more inventory, slower price growth, and opportunities for buyers taking advantage of lower interest rates, particularly for single-detached homes.

In the Greater Toronto Area and surrounding suburbs, price adjustments, increased listings, and declining interest rates are creating conditions favourable for buyers, though affordability pressures remain, particularly for first-time buyers. Year-over-year, home prices in the Greater Toronto Area fell by 3.5 per cent, from 2024 to 2025, from $1,127,525 to $1,088,166. Across the province, rental pressures, limited inventory in key segments, and evolving economic conditions are motivating buyers to plan and act strategically, while technology and online tools continue to streamline buyer’s property search and decision-making.

Market-by-Market Overview

RE/MAX OUTLOOK CANADA WIDE, CLICK ON EACH TO VIEW REPORTS.

ST. JOHNS, NEWFOUNDLAND OUTLOOK

SOURCE, RE/MAX CANADA

To read more, visit RE/MAX CANADA